More integrated servicesĪ CEX can offer a wide range of products and integrated services, turning it into a one-stop crypto shop. These measures support users and protect them from making the irreversible mistakes people sometimes make on DEXs. For example, customer support can help if you lose access to your Binance account, and there's no need to pay gas fees when moving your crypto around Binance's products. You can avoid these pitfalls if you trade using a CEX. There are no system admins to offer assistance, so you're on your own if you lose your seed phrase or send crypto to the wrong wallet. Crypto wallets, addresses, gas fees, and other aspects of blockchain can be unforgiving when you make mistakes. One of the biggest hurdles for crypto beginners when using DEXs is getting used to decentralized tools. Most CEXs offer payment with credit or debit cards, making your first crypto investment as simple as possible. Many of us are already familiar with this system, and technical knowledge is not a must-have. The process of registering with a CEX is similar to opening a bank account. A CEX will also likely have detailed guides as part of its services (Binance Academy is one example). Newcomers to crypto have access to simple conversion tools like Binance Convert, while experienced traders can use the Spot Exchange's TradingView tools. Centralized Exchanges: Pros User-friendlyĪ CEX like Binance focuses on providing user-friendly experiences for all kinds of users. A DEX also has several benefits but these are typically more attractive to experienced crypto users who value decentralization over ease of use.

If anything goes wrong, you can contact the exchange's customer support team.

Binance dex wallet registration#

Due to its decentralized nature, there's no registration or account required of its users.įor newcomers, a CEX offers a more user-friendly experience and is an easier entry point. To use a DEX, you only need a crypto wallet and some crypto (including enough for any gas / transaction fees ). Instead, they mainly use the automated market maker (AMM) model.

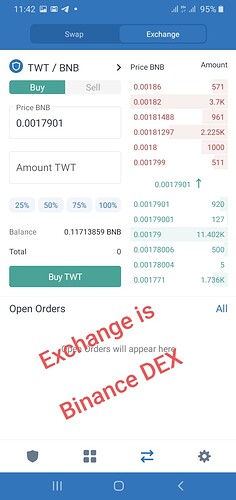

Unlike CEXs, DEXs typically don't use order books to facilitate trading. An entity or project may create and help run a DEX but it can, in theory, run itself as long as people provide liquidity to it.

Binance dex wallet code#

The exchange will also take custody of the assets you want to trade on the CEX after you’ve deposited them into your CEX account.Ī DEX, however, is run through smart contracts, which are self-executing pieces of code on a blockchain. To use a CEX like Binance, you must create an account and verify your identity according to local regulations. The order book then matches buyers with sellers, taking a small cut of the transaction as a fee.Īt the heart of the operation are the order book and exchange entity, making the model centralized. A CEX works similarly to what you'd find in the world of stocks - a single entity operates using an order book in which market makers and takers place orders. If you're a new trader or only have experience in traditional finance, the difference between a CEX and DEX can be confusing. Why Are There Different Types of Exchanges? Depending on what you want to do and your level of experience, each has its advantages and disadvantages. No matter your story, you should know the crucial differences between a CEX and DEX before deciding which to use. Perhaps you're already a customer with a CEX like Binance but are interested in using a DEX, or maybe you're looking to purchase the latest DeFi coin not currently available on CEXs. If you've been doing your crypto research, you'll likely have come across DEXs. However, they lack the support a CEX can give, and it can be easy to make irreversible mistakes when using them. DEXs are the gateway to the decentralized finance (DeFi) world and provide users with a lot of freedom. You don't need to register for a DEX, meaning they're open to anyone with a wallet and some crypto. In most cases, users swap tokens from liquidity pools, with liquidity provided by other users in exchange for swap fees. For beginners, a CEX provides the simplest way to get started without needing in-depth knowledge of blockchain infrastructure and tools.Ī decentralized exchange (DEX) uses on-chain smart contracts to run its exchange services. Its primary service typically matches buyers and sellers with an order book, though a CEX may offer its verified users various crypto products. A centralized exchange (CEX) offers cryptocurrency exchange services to registered users.

0 kommentar(er)

0 kommentar(er)